Is Your Vacation Home Properly Protected?

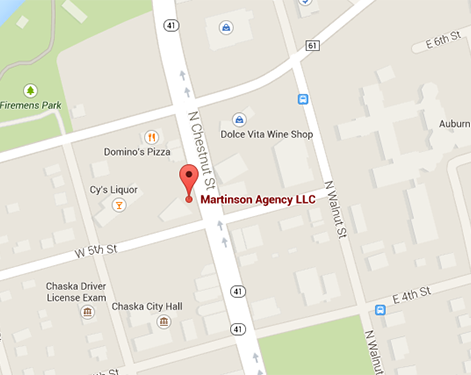

June 23rd, 2016 — Martinson Agency LLC — Chaska, MN

Vacation homes serve as sanctuaries from the daily stresses of life. And more and more people are investing in them. In 2014, vacation home sales soared to new heights, totaling 1.1 million, according to the National Association of Realtors – nearly 60% more than the previous year.

The question is, are Americans properly protecting their fortresses of solitude? With the median vacation home costing approximately $150,000, these investments are significant.

If you own a vacation home, the following are a few things to take into consideration to properly protect it.

Property Crime

If you’re like most vacation homeowners, your home away from home is used when you’re, well, on vacation. If you don’t rent it out, that leaves lots of time where it’s unoccupied – making it susceptible to theft.

According to the most recent data available from the Bureau of Justice Statistics, property crime in 2014 – including burglary – fell from the previous year. That’s good news, but at 118 victimizations for every 1,000 households, it’s still cause for concern.

Check out Consumer Reports for reviews on home alarm and surveillance systems. Thanks to the Internet, you can see what’s happening at your retreat in real-time. Also, make sure your homeowners insurance policy is up to date by speaking with your agent. Also consider performing a home inventory so you know the proper amount of coverage to secure.

Weather Extremes

Have you ever thought about what would happen if the water pipes in your vacation home burst? You’d have one heck of a messy situation on your hands, especially if you’re nowhere near the property to fix what’s broken. Well, if your water is left on when the temperatures plummet and the pipes freeze, it can happen. That’s why it’s worth your while to do some research on caretaker services. If you visit MindMyHouse.com, you’ll find further information about property caretaking providers and services all around the country. As detailed by The New York Times, property caretaking has become something of a “cottage” industry.

Condominium or Single Family?

When it comes to insurance, the type of property you own helps determine the policy that’s best suited for your needs. For instance, if you own a condominium rather than a single-family residence, your condo association may already have coverage. At the same time, the insurance that the association has may only protect the physical structure of the condo, not your belongings. Be sure to look into this before you consult with your independent agent.

Amenities

Vacation homes often serve as getaways from the stresses of life. As such, it’s not uncommon for owners to have various amenities, be it a swimming pool, hot tub or trampoline, among others. Because accidents are possible with these kinds of recreational items, you may want to speak with your independent agent about the liability portion of your insurance policy and your liability limit to ensure your assets are adequately protected in the event someone is injured on your property and files a lawsuit against you.

Your vacation home’s value is an additional factor that can help you assess your insurance needs. As previously mentioned, the median price for a vacation home in 2014 was $150,000. However, homeowners insurance premiums are determined by how much it would cost to rebuild your residence from scratch should it be destroyed. Your independent agent and insurance carrier can work with you to determine the appropriate amount of coverage you might need.

For more information on this topic give the Martinson Agency in Chaska, MN a call today!

Don’t leave your insurance to luck! Call today us today!

Phone: (952) 314-4400

Email: jphagen@aibme.com

Contact

Contact Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions