Do College Students Need Renters Insurance?

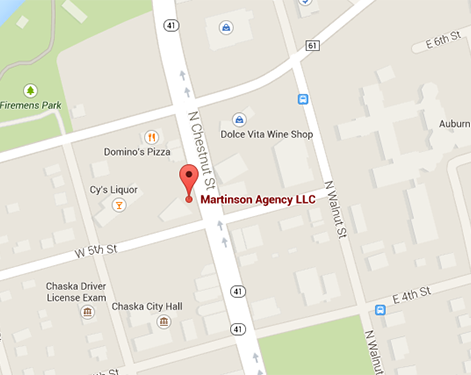

September 15th, 2016 — Martinson Agency LLC — Chaska, MN

Parents will face plenty of stress when sending their kids off to college. The safety and security of college students’ personal items – including bicycles, computers and other, more expensive belongings – will likely come to mind, begging the question of whether or not to purchase a renters insurance policy.

It is worth noting that most home owner’s policies extend some contents and liability coverage to family members away at school. However, the types of smaller, more likely losses that happen at college may also be less than many homeowners policy deductibles, potentially leaving families to self-insure such property. In addition, what might be covered in a college dorm might not be covered in an off-campus apartment rental. Your independent agent can help you navigate all the questions and options to ensure you have the information necessary to make the right decision.

If possessions and personal liability are not going to be fully covered by your home owner’s policy, you will need to weigh the cost of renters insurance against the benefits.

Let’s break down the facts to help you to decide how to proceed:

- The National Center for Education Statistics, a government agency tracking higher education trends, recorded 27,600 incidents of crime at universities in 2013. Roughly 15,500 of those – or 56 percent – were burglaries.

- Citing FBI data, news publication USA Today reports bicycle thefts are the leading crime at college campuses, with an average loss of $250 per incident and annual damages adding up to $350 million. As noted below, most basic renter’s policies are fairly inexpensive, so it may be hard to imagine the yearly cost of renters insurance being higher than a potential theft or loss.

Consider the following information:

- The National Association of Insurance Commissioners, a trade organization for insurance regulatory professionals, estimates the average monthly premium for renter’s insurance falls between $15 and $30.

- Computers, textbooks, bicycles and other common items kept in dorm rooms and college apartments can be easily valued in the thousands of dollars.

- CNN Money noted renters insurance can cover liability and extra living expenses in addition to personal property.

At the end of the day, you might want to reach out to a professional to figure out if renters insurance is right for your student. Contact the Martinson Agency in Chaska, MN today to gather more information.

Don’t leave your insurance to luck! Call today us today!

Phone: (952) 314-4400

Email: jphagen@aibme.com

Contact

Contact Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions