Ride Sharing (Uber & Lyft) Coverage

May 4th, 2017 — Martinson Agency LLC — Chaska, MN

So you’re a ride share driver for Uber or Lyft, generating extra income or maybe even working full-time using your personal vehicle to transport others. You love the freedom of setting your own hours and traversing the city with interesting people in tow. Make sure you understand when your personal auto insurance policy affords coverage for Ride Sharing and when it does not.

Where’s Your Coverage Gap?

The entire time your TNC app is on, your personal auto policy is suspended. Your TNC does provide coverage, but only for the period of time between accepting the passenger and dropping off the passenger. No passenger means no coverage for your vehicle and any damages or injuries you may sustain or cause.

Safeco Ride Sharing Coverage steps in to cover you between passengers, effectively closing the gap.

Safeco Ride Sharing Coverage Fills in the Gap – and Then Some

Extend your personal auto policy: With Safeco Ride Sharing Coverage, you get nearly the same coverage during applicable ride sharing activities as you do any other time you drive. Most of the coverage and options you selected for your Safeco auto policy extend to your Ride Sharing Coverage.

Identify which vehicle you use for ride sharing: Your Ride Sharing Coverage will only apply to the vehicle specified on your policy. If you have other vehicles insured with Safeco, the coverage will not apply to them unless you purchase coverage for each one.

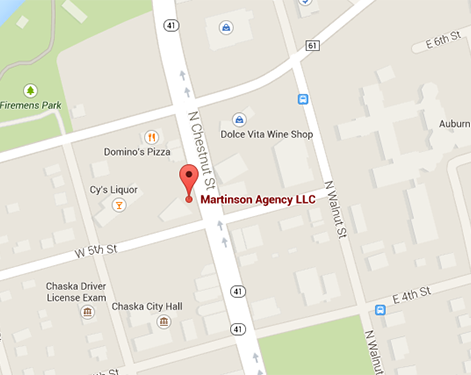

Contact your local independent agent at the Martinson Agency in Chaska, MN today for more information regarding Ride Sharing coverage and how it may be handled with your current policy.

Don’t leave your insurance to luck! Call today us today!

Phone: (952) 314-4400

Email: jphagen@aibme.com

Contact

Contact Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions