The Importance of Personal Umbrella Coverage

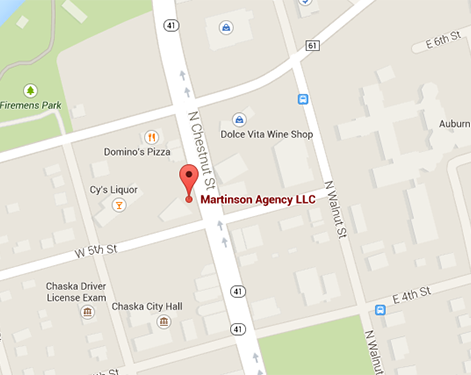

September 3rd, 2017 — Martinson Agency LLC — Chaska, MN

Your auto and homeowners insurance policies are designed to keep you protected, but sometimes that isn’t enough. Unfortunately, bodily injury and damages from a bad at-fault accident can quickly exhaust the liability limits of your standard insurance policy.

A personal umbrella policy is an extra layer of protection that goes above the normal homeowners and auto insurance liability limits. It provides higher limits and broader coverage, and can help pay legal defense costs you may incur after your basic insurance policy limits are exhausted.

Here are a few reasons why you should look into purchasing a personal umbrella policy:

- Protects your assets. Having a personal umbrella policy helps ensure your assets—your car, home, investments, retirement accounts, checking and savings accounts, and even your future income—are protected in case of an unforeseen accident that exceeds your auto or homeowners limits.

- Better protects you. You are protected for incidents that you might not even consider, such as if you are liable for injuries while renting a boat or Jet Ski, or even driving a car provided by your employer.

- Offers peace of mind. An umbrella policy provides peace of mind that you, your loved ones, and your assets are protected against large lawsuits.

- Covers legal fees. The costs of legal defense can be staggering and must be paid even if you win. A personal umbrella policy can help offset these costs without draining your savings.

If you haven’t considered the added protection of an umbrella policy give our office a call so we can answer any questions that you may have. In most cases an umbrella policy is the most affordable coverage you can buy. Don’t leave your insurance to luck! Call Martinson Agency today!

Martinson Agency LLC – Chaska, MN

(952) 314-4400

Contact

Contact Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions