Insurance 101: Life Insurance

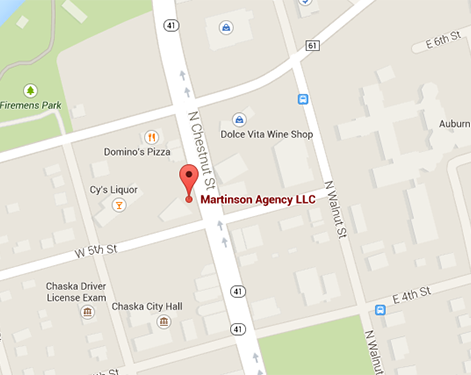

July 9th, 2015 — Martinson Agency LLC — Chaska, MN

In the event of your untimely death, ensuring your family’s financial protection is critical. Life Insurance is the asset that can help you do that. You can count on our well trained staff to help you attain a life insurance policy that is specifically tailored around you and your family’s needs.

Some of the most common forms of life insurance include:

- Term Life

- Whole Life

- Universal Life

So what is term life insurance? Term life unlike whole life insurance, has a set time period. At the end of the period, it is up to the policy holder to decide whether to renew the policy or let the coverage end. This option is comparable to renting an apartment. At the end of your lease you either move out, or choose to renew for another term.

A traditional whole life insurance policy on the other hand, never runs out. Upon the death of the policy holder, the insurance payout is made to the contracts inheritors. A whole life policy also has a cash value option. This means that if the policy holder reaches the age of 100 he or she can take whatever cash value is available. This option is more comparable to purchasing a home.

Universal life insurance is a more flexible form of permanent life insurance. It offers the low cost protection of term life while also offering the savings component of whole life insurance. The unique feature of a universal life insurance policy is the fact that the policy holder can review and alter the death benefit, savings component and premium as his or her circumstances change.

Regardless of what type of life insurance you choose, we are able to go over the options and find the best quotes so you can maintain an affordable policy. We’re independent agents, working with multiple carriers for your benefit. Call the Martinson Agency today to learn more about your Chaska, MN life insurance options.

Don’t leave your insurance to luck! Call today!

Phone: (952) 314-4400

Email: jphagen@aibme.com

Contact

Contact Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions