Insurance 101: Homeowners Insurance

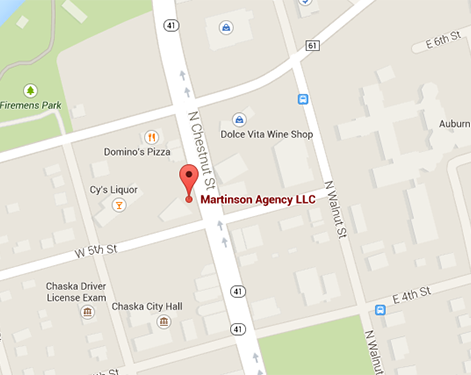

August 13th, 2015 — Martinson Agency LLC — Chaska, MN

Homeowners insurance can provide protection for you and your family in the nastiest of situations. It is important to understand your homeowner’s policy in order to take advantage of everything that it has to offer. This article will highlight a few of the things you should know about your homeowners insurance policy.

What does a home insurance policy cover? This is one of the most important questions that you can ask during the quoting process. A typical policy will cover damage to your property and possessions in the event of a storm, fire, theft or vandalism. It will also provide you with personal liability coverage. This means that if someone gets injured on your property and decides to sue, you’re covered. Homeowners insurance will also pick up the tab for temporary shelter costs should you be displaced from your home due to a covered loss. Your home policy can also protect your personal belongings while they’re traveling with you. For example, if you have an item stolen from your car it will be covered by your home policy, not your auto policy.

One common misconception pertaining to home insurance is the actual insurance value of your home. It is important to understand the difference between insurance replacement cost and the market value of your property. Market value is easily defined as the value of your home, land included, if you were to list the property for sale. Obviously this value can fluctuate based on the housing market and can be greatly impacted by the location of your home. Insurance companies however, consider the actual replacement cost in the event that they have to rebuild your home. This is an important distinction and means often times you’ll have to insure the home for more than the property’s “market value”.

Make sure to maximize your discounts. One of the best ways to save some money on your home insurance policy is to bundle it with your auto insurance. Insurance companies will give you a discount on both your auto and home policies for bundling. Paying your home insurance in full for the year rather than making monthly payments is another great way to lower your premium. If you are curious as to what other discounts are available to you make sure that you do your research and contact your agent right away.

Understanding your homeowner’s policy is critical. As a consumer you should make it your priority to know what your policy covers as well as know all of the available coverage options. In the end it will cost you far more if you are uninsured or under insured at the time of a loss. If you have questions about your policy or are looking for a quote give Martinson Agency in Chaska, MN a call today!

Don’t leave your insurance to luck! Call today!

Phone: (952) 314-4400

Email: jphagen@aibme.com

Contact

Contact Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions