Car Safety for Pets

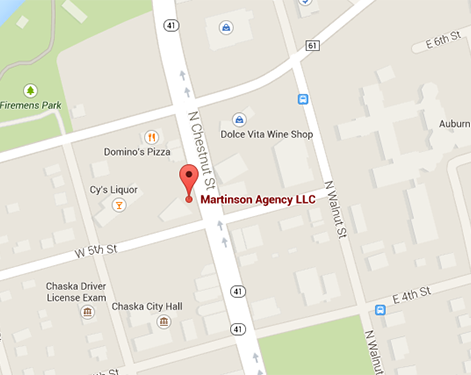

June 11th, 2015 — Martinson Agency LLC — Chaska, MN

Summer has officially arrived in Minnesota and that means that road trip season is upon us! Car safety is important this time of year and often times we forget our four-legged friends. Many just assume that cats and dogs roaming free in your vehicle is an accepted practice and while it may not be against the law, it doesn’t mean you shouldn’t consider these important safety tips while traveling with your pet.

1. “DO NOT let your pet sit on your lap” We’ve all seen it. And sure its cute. Sure, the car next to you may look over and wave. But it isn’t safe. And it shouldn’t happen. Not only does this put you and other drivers at risk, but it puts your animal at risk as well.

2. “Consider a pet carrier for cats and smaller dogs” Many times smaller animals can be more distracting while on the road because they can move though out the vehicle quicker and fit into smaller spaces. Using a pet carrier restricts the freedom your pet has while providing comfort at the same time.

3. “Use a travel barrier” A travel barrier works great for animals of all shapes and sizes. This is a simple option that keeps your pet in the backseat. Most barriers are adjustable so you can customize it to meet you and your animal’s needs. Don’t forget to turn on A/C in the back to keep your buddy cool and comfortable throughout your trip!

4. “DO NOT leave your pet in the vehicle on a hot day” This is another that seems obvious and yet something that happens all too often. Your dog or cat doesn’t have the freedom of turning on the A/C if they start to overheat so don’t put them in this position. You have options. Have a fellow passenger stay with the dog while the vehicle is left running. Take the dog out of the vehicle while you are making a quick stop. If you must leave the animal alone for a moment, make sure that the windows are left open enough for proper air flow. But please, make it quick!

5. “Remember: Not all animals enjoy car rides” Sure, some animals love going for a car ride. But please remember that not animals feel the same. They may become fearful, anxious or car sick and all of these issues can lead to distracted driving. If you own an animal that hates the car, please avoid long road trips. Obviously, some situations are unavoidable and in this case be sure to make your pet as comfortable as possible before you hit the road.

Traveling can be an enjoyable experience for your family and your pet this time of year. Just please consider the safety of not only your family, but the safety of others on the road as well. Make sure that before you hit the road this summer, your pet is comfortable and relaxing in a safe place.

Don’t leave your insurance to luck! Call today!

Phone: (952) 314-4400

Email: jphagen@aibme.com

Contact

Contact Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions