What You Need to Know About Leasing a Vehicle

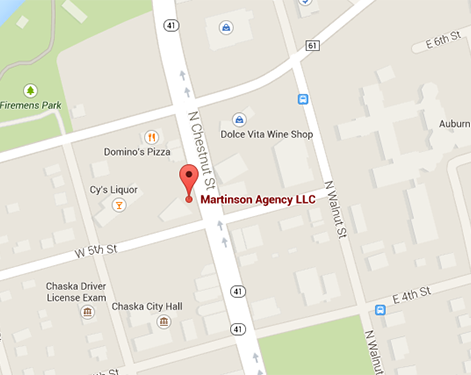

March 2nd, 2017 — Martinson Agency LLC — Chaska, MN

Leasing a car is becoming more and more popular as time goes on. Leasing offers significant benefits as compared to purchasing a vehicle. Edmunds, a research publication that focuses on the automotive market, released the following data from its study last summer on leasing:

- The first half of 2016 saw the highest number of new car leases on record.

- Over the past five years, the number of car leases has doubled.

- Millennials represent the largest group of lessees at more than 34%.

- When looking at the whole, lessees pay 23% less each month on average than those who have a financing program

If you are one of the many Americans considering signing an automobile lease, there are some things you should know.

The Basics

Anyone interested in leasing a car should first understand whether or not it’s the right move compared to buying, according to US News. For example, the source explains that the standard lease agreement puts a limit of 9,000 to 15,000 miles annually. If you think you are going to exceed that, it might not benefit you to lease given the immense penalties you could end up paying. On the other hand, individuals who are committed to maintaining their leased vehicles or desire an automobile they wouldn’t otherwise be able to afford, are indeed strong candidates for this path.

Bankrate, a financial website, urges consumers to avoid five common mistakes in the leasing process, including, paying exorbitant sums up front, failing to maintain the interior and exterior of the vehicle, and leasing a vehicle for more time than the warranty period. Bankrate also notes that failure to get gap insurance could lead to financial peril for the lessee.

Since Coverage is an important factor in this conversation, let’s look further into the key matters involved.

Insurance Considerations

The Insurance Information Institute offers some helpful guidance to individuals who are looking to lease a car and protect themselves from the potential financial damages that could accompany theft or an accident. In most instances, you will have to keep comprehensive and collision coverage, but this will rarely cover the entirety of your liability if the vehicle is completely totaled. That’s where gap coverage comes in. Gap coverage, sometimes referred to as loan/lease coverage, reimburses the lessee in the event of an accident and there’s a “gap” between the amount owed the auto dealer and the insurance claim payment.

The vast majority of consumers will not have to purchase their gap insurance separately, but rather foot the bill as part of the monthly payment to the lessor.

Make sure that you read all of the fine print on leasing contracts, especially the content related to insurance and liability, before signing on.

With any questions regarding coverage when leasing a vehicle, give your insurance professionals at the Martinson Agency in Chaska, MN a call today!

Don’t leave your insurance to luck! Call today us today!

Phone: (952) 314-4400

Email: jphagen@aibme.com

Contact

Contact Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions